BUSINESS OWNERS & ENTREPRENEURS

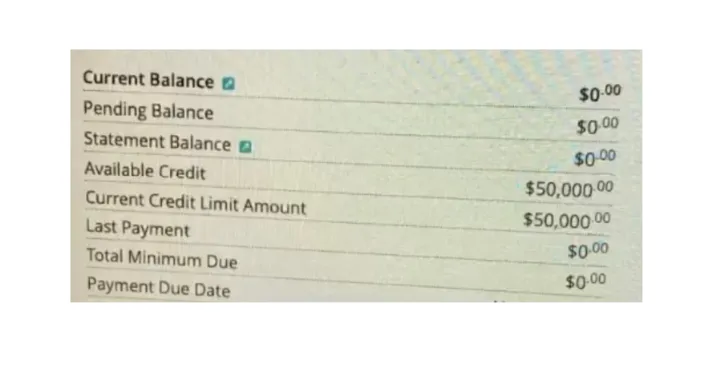

$50K+ TO $200K AT 0% APR

FUNDING FOR YOUR BUSINESS

With a Guaranteed Funding Strategy, running your business becomes effortless, because you have a cash flow that works FOR you and not against you.

Make sure your sound is turned on (Please wait for video to fully load)

DOES THIS WOC STRATEGY

ACTUALLY WORK?

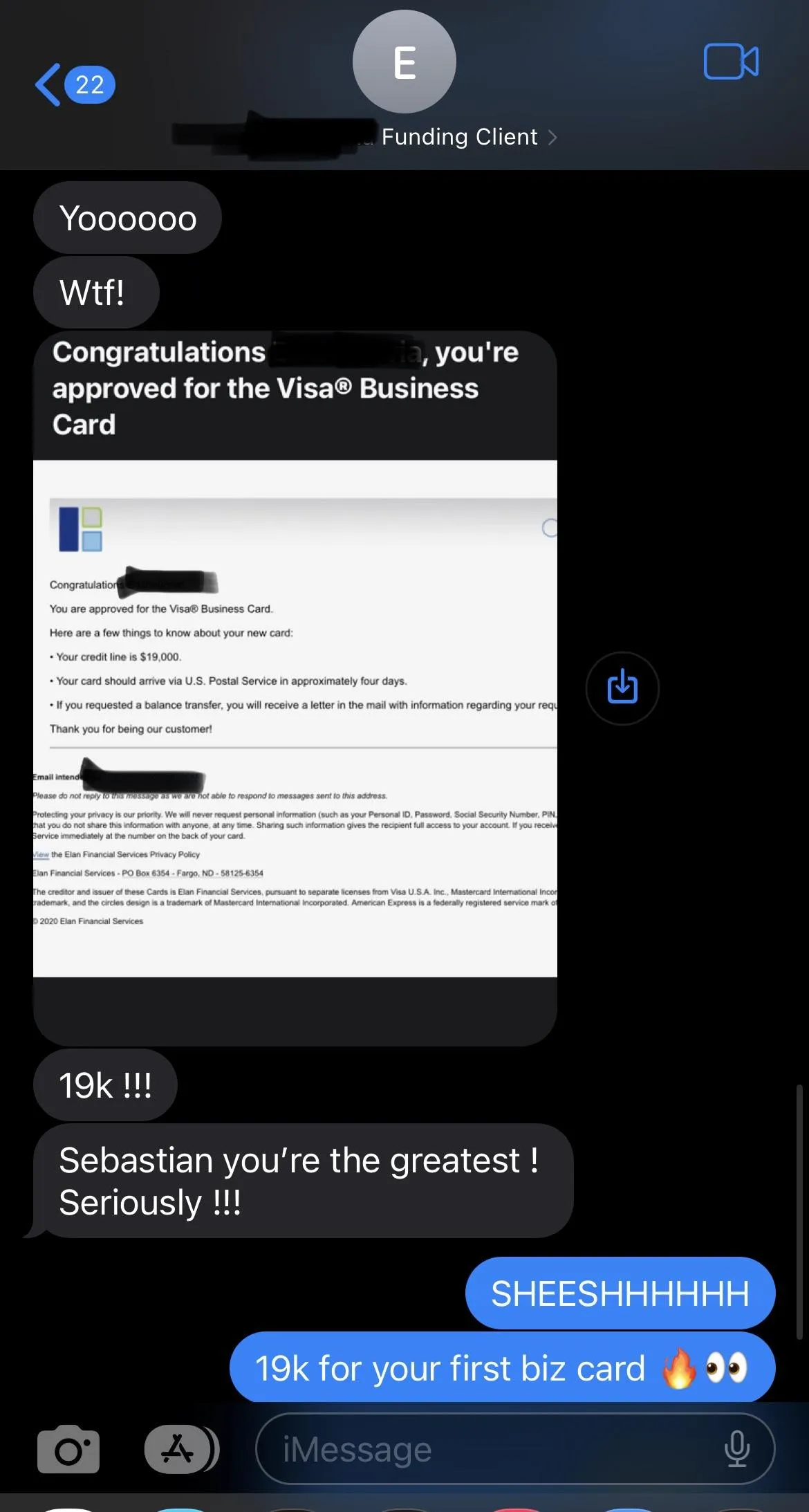

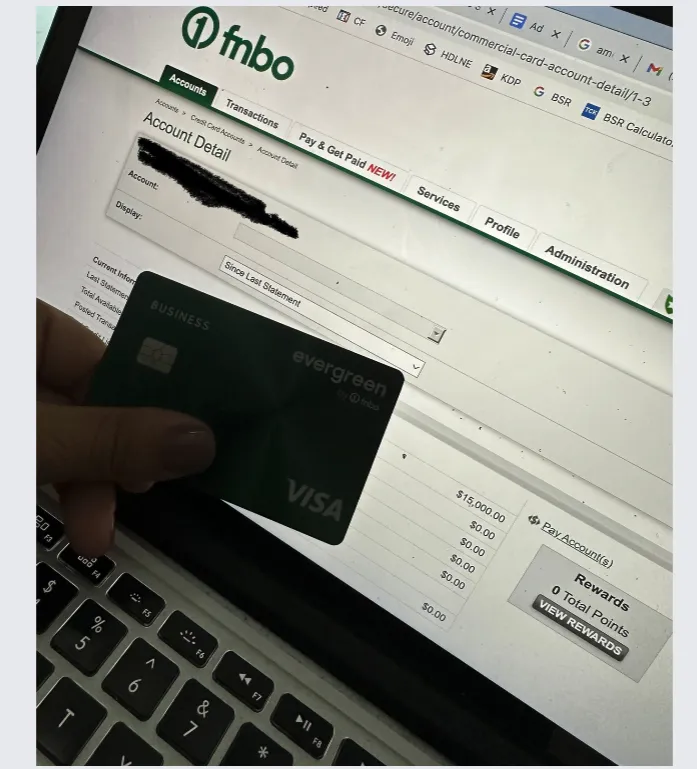

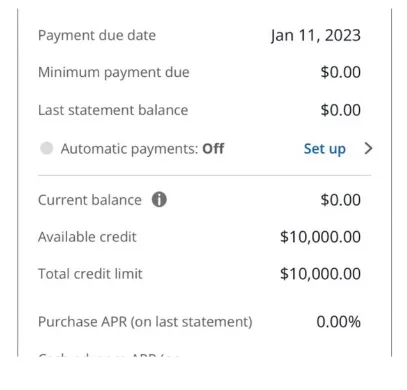

Alex Gonzalez

AZ Enterprises

Niche: Airbnb

Result: $76,000 in 3 weeks

AZ Enterprises: Alex was able to secure $76k with 0% APR within 30 days of starting his business.

Alexander is a union worker and although he has a great paying job it's extremely hard work. He wanted to start his Airbnb business so he can replace his income and become a full time business owner.

The Process:

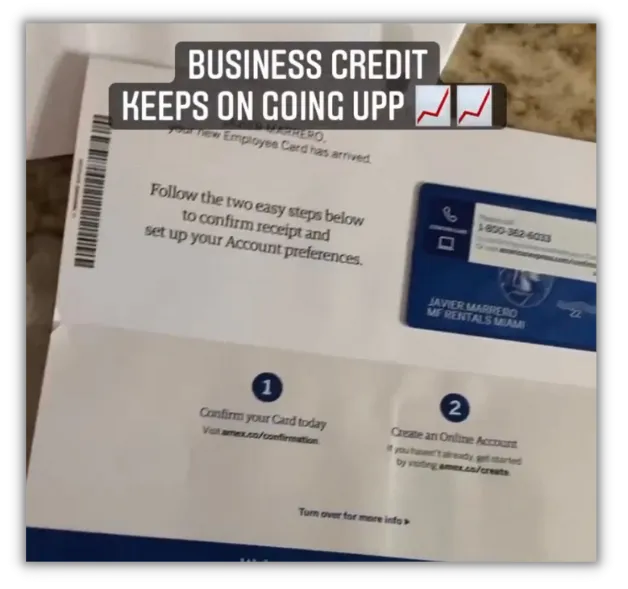

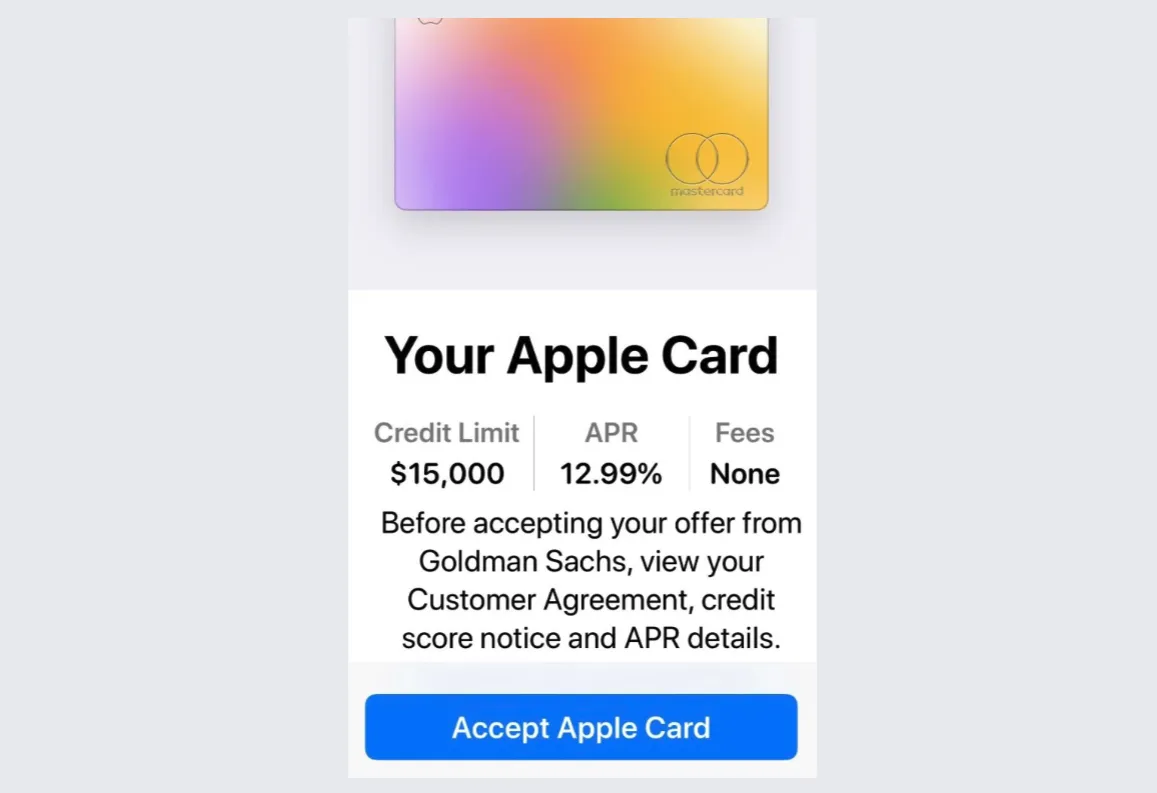

When we first started working with Alex we guided him on boosting his personal credit by paying down his credit cards to under 10%. After the balances were updated we built relationships with a couple banks and successfully applied for business credit cards.

The Result:

We were able to fund him with a $76,000 of 0% APR business credit card even with a very young personal credit profile, now he is ready to invest into his first Airbnb property and start generating cash flow to fire his boss and become a full time CEO.

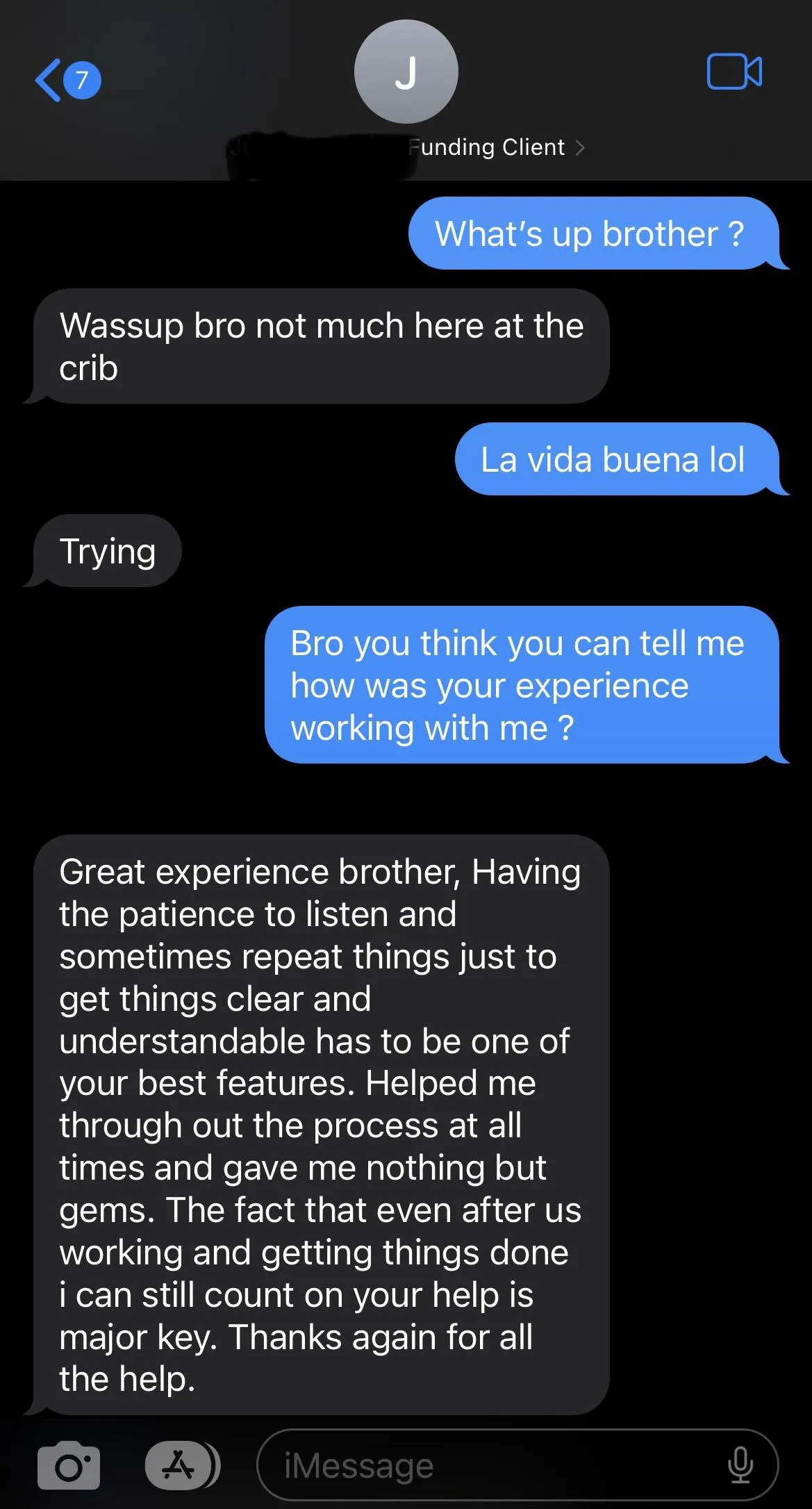

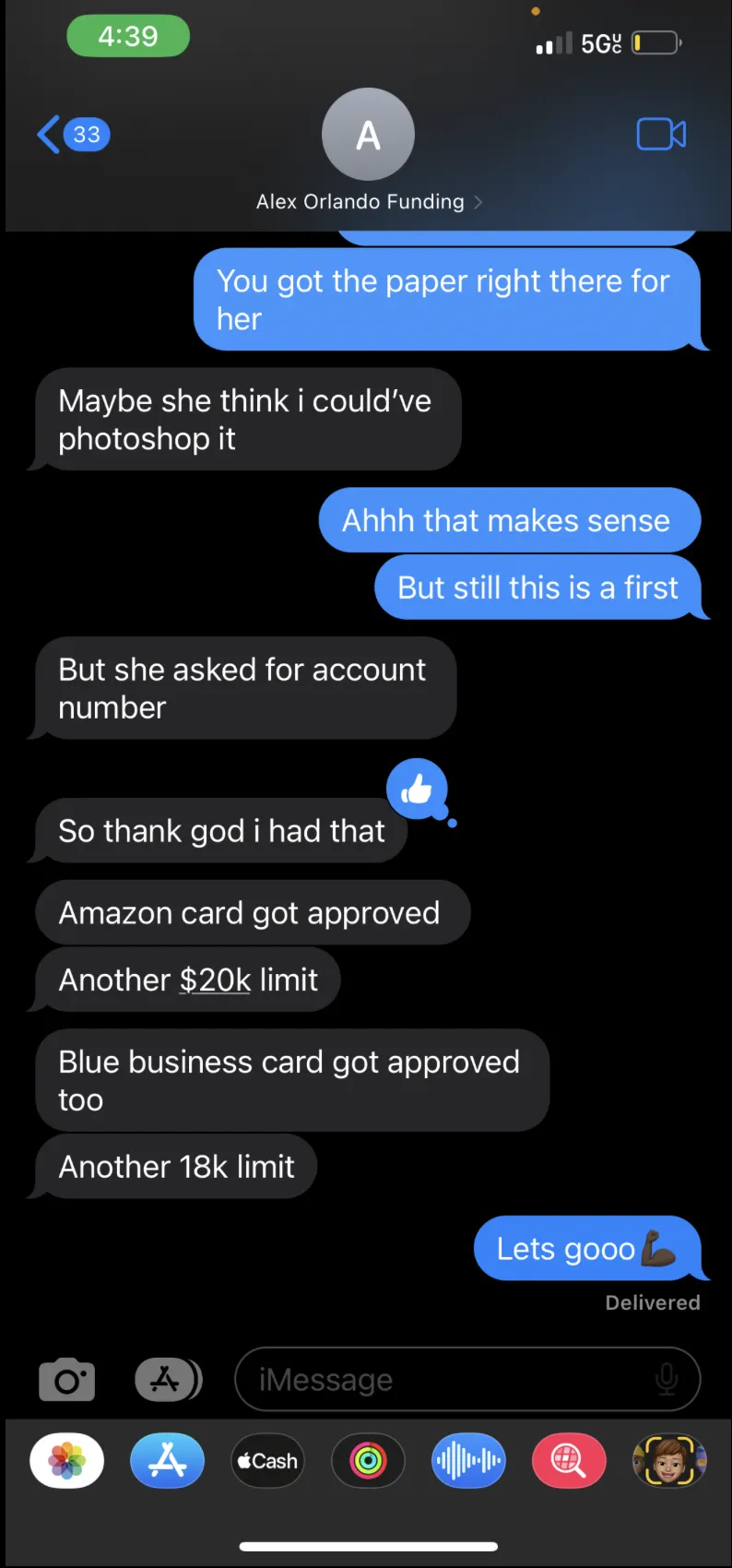

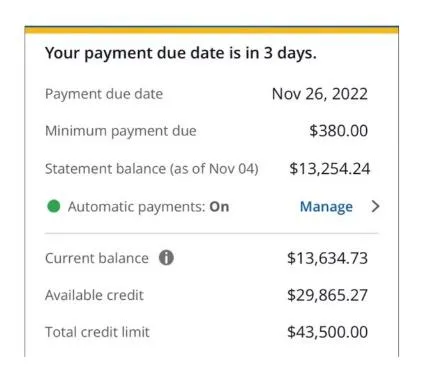

Michael Scalenio

Arch + Design Consultants

Niche: Commercial Real Estate

Result: $150,000 in 56 days

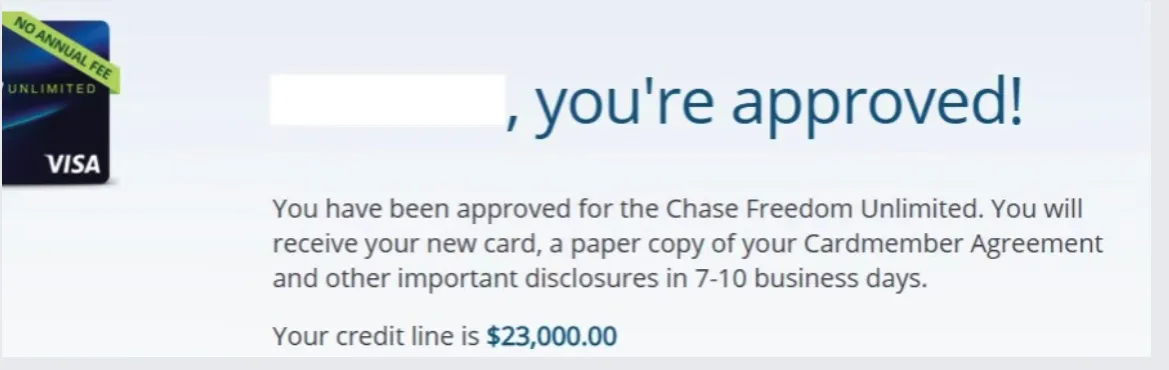

Arch + Design Consultants : Mike went from $0 to $150k in under 60 days!

When Mike reached out to use he was limited to the amount of projects he could do and contractors he could hire due to having all his cash tied up into the properties he was working on. There was no way he'd be able to scale, hire more contractors and take on more projects at once which he was more than capable of doing, he just didn't have the capital needed to do so.

The Process:

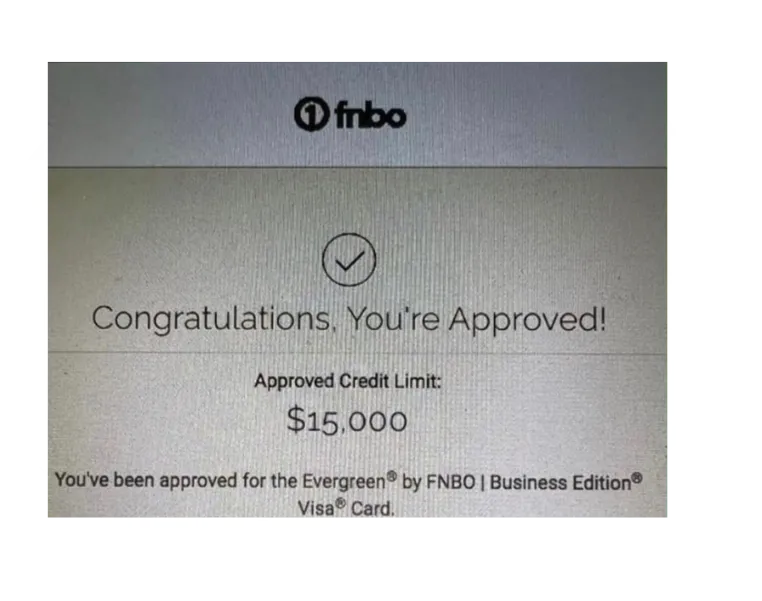

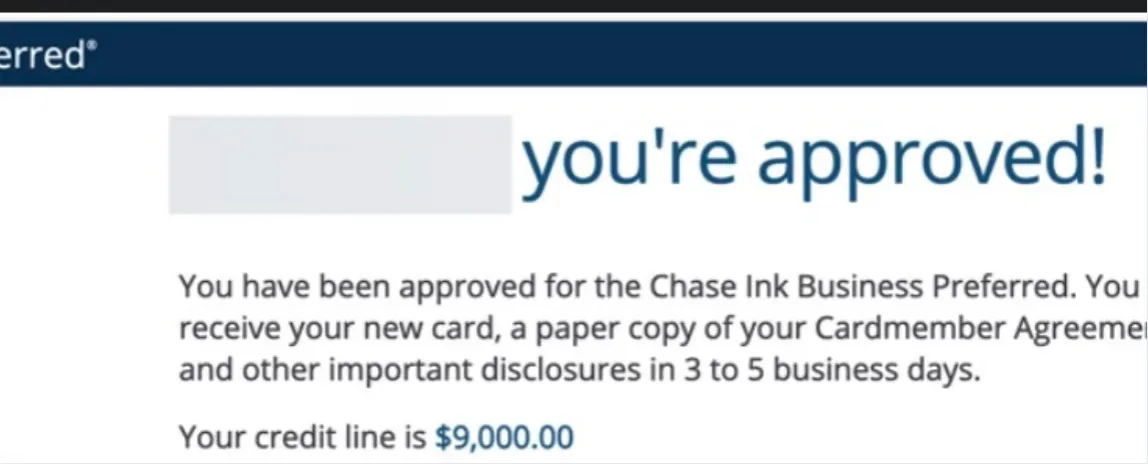

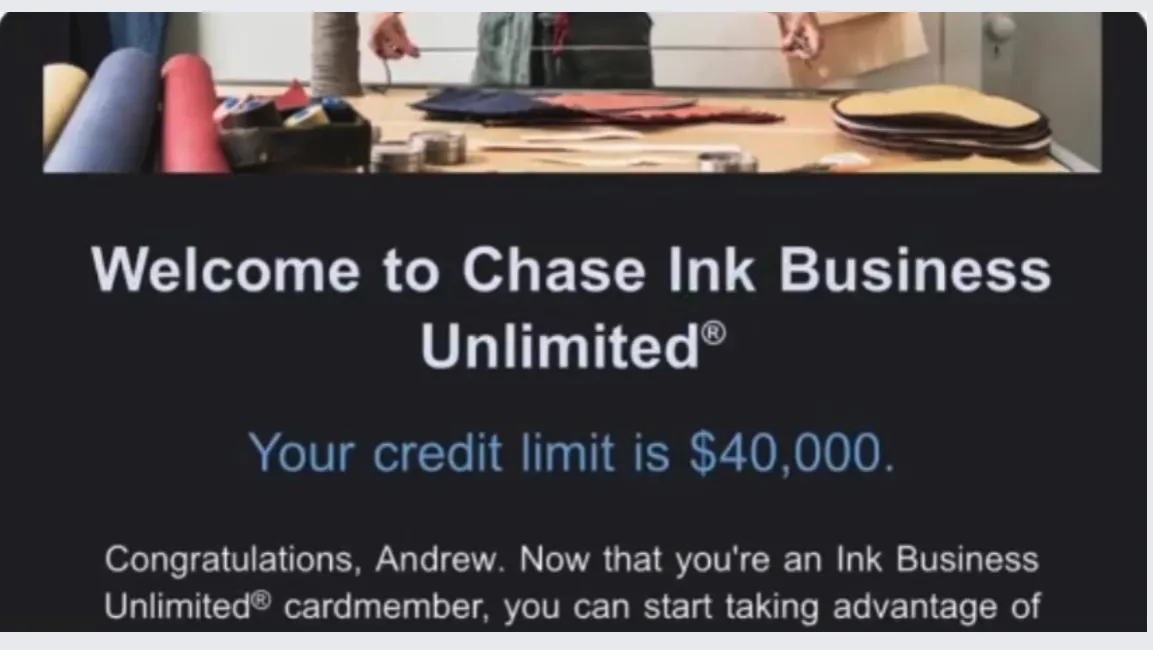

Michael was a referral from a previous client we worked with. He was adamant about getting at least $50k because he missed out on many deals due to lack of capital and had no way of paying additional contractors until a project was completed. After reviewing his credit report and current bank relationships we customized a funding process for him and he was able to secure 3x what he needed! The $150k was only between 2 banks, including 2 lines of credit so he could have immediate cash on hand.

The Result:

Michael was able to use the line of credit to pay his contractors and utilize the 0% interest card for down payments on multiple projects, then use the profit from the projects to pay off the card so he spent none of his own money! To top it he was able to accumulate a ton of cash back from his investments!

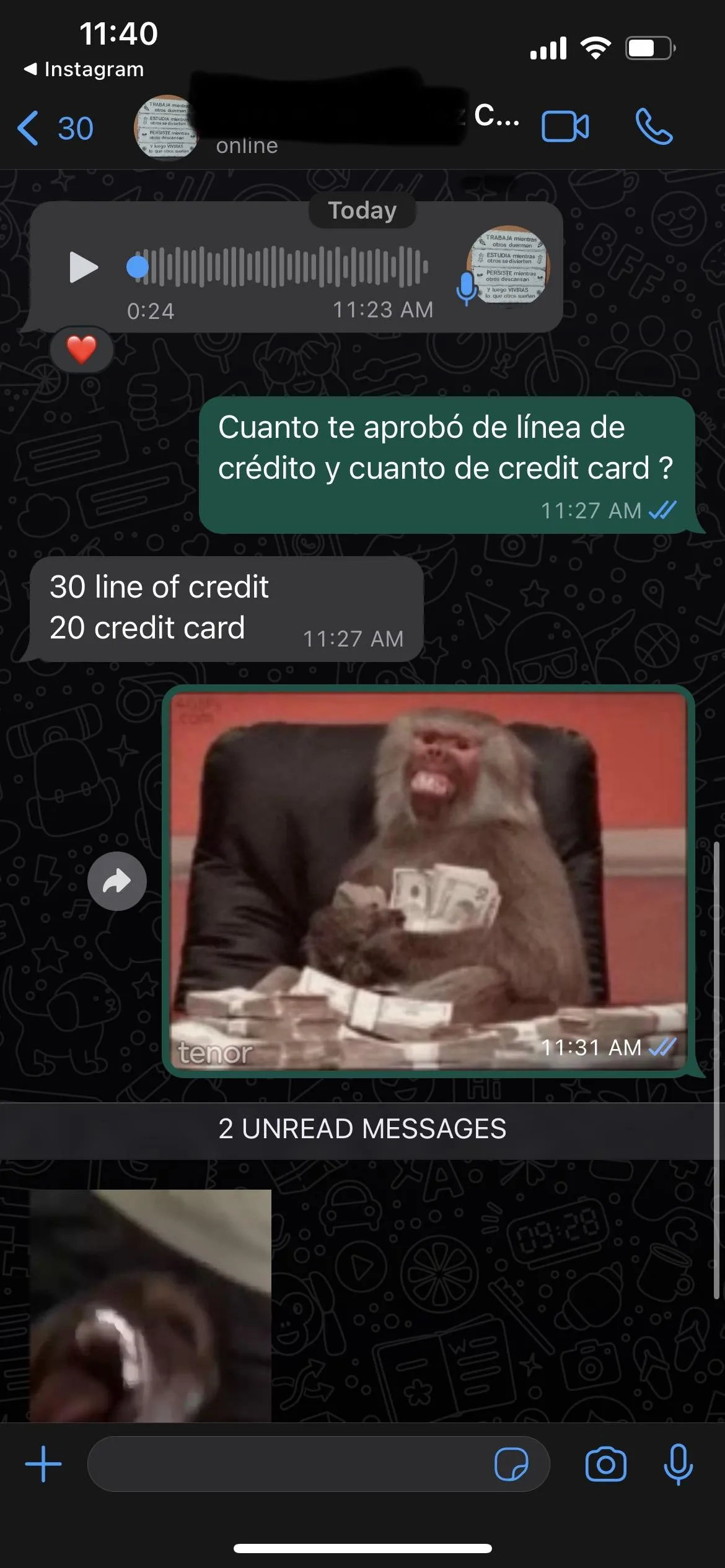

Jose Fernandez

Results: From $0 to $200k in Business Lines of Credit!

Fernandez Carpentry: Jose went from $0 to $200k in business lines of credit!

When Jose came to us, his goal was to get only Business lines of credit to expand his business and invest into his real estate portfolio. He wanted access to the instant cash that Business lines of credit offer.

The Process:

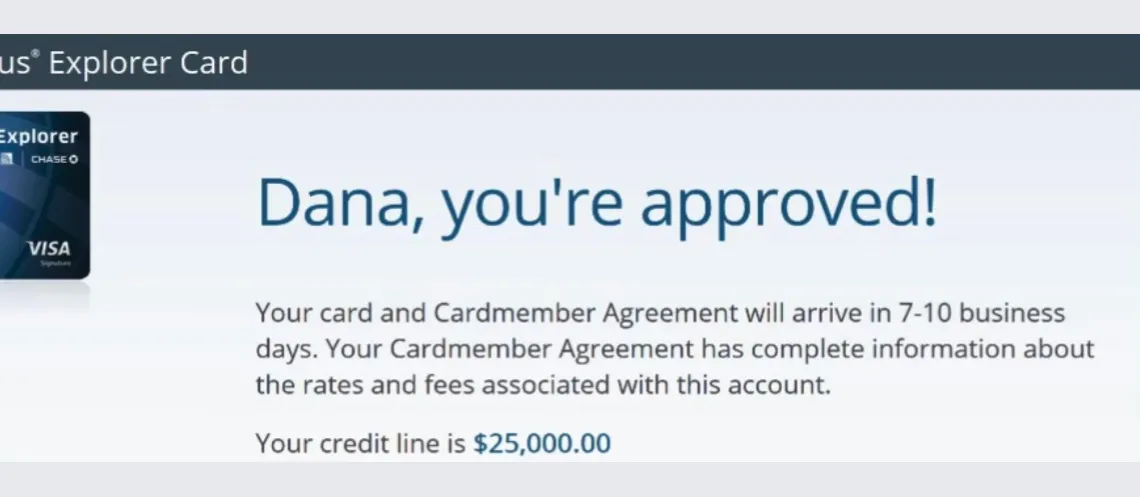

When we started the process with Jose we set a step by step strategy on which banks to create relationships with to be able to acquire business line of credit ! Jose did his part and followed the funding strategy.

The Result:

We Were able to help Jose get approved for 200k + in funds to expand his business. He is currently expanding his Real estate portfolio as well by using the Business lines of credit to put down payment on Rental properties.

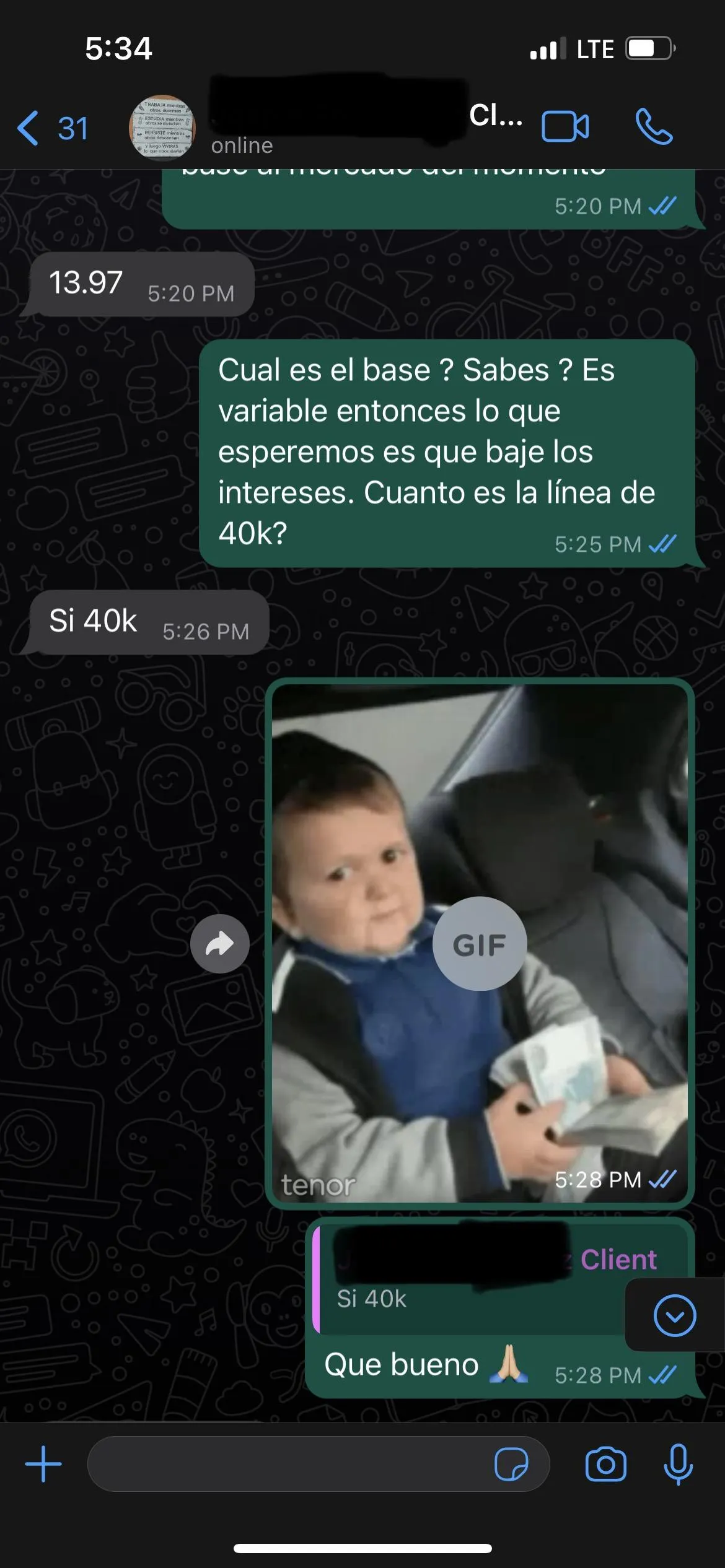

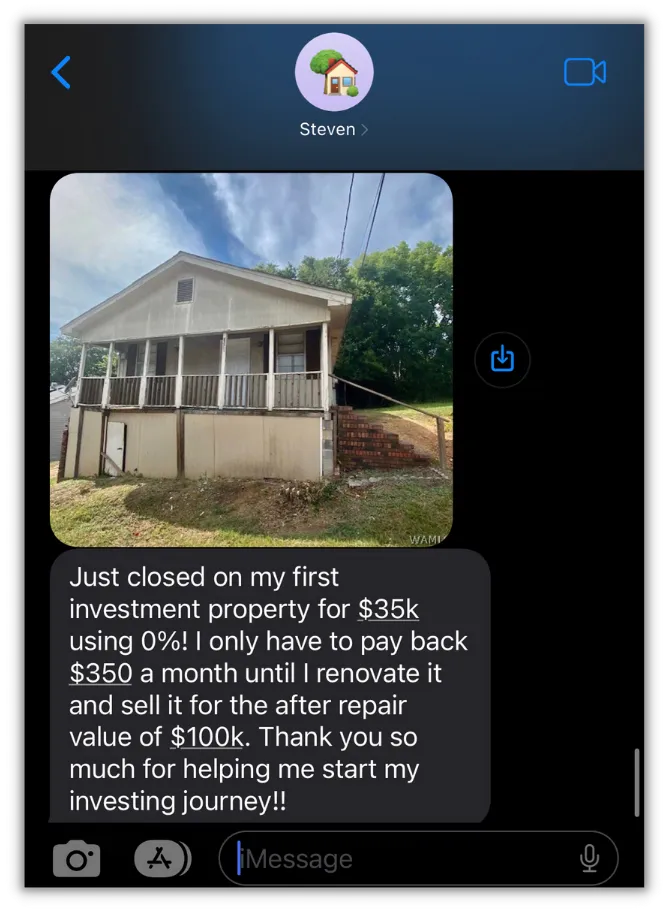

Atomic Soler

Steven & Joaquin Soler

Niche: Real Estate Investing

Results: From investing with cash to OPM

Atomic Soler: Steven Soler Went From Investing with Cash to OPM

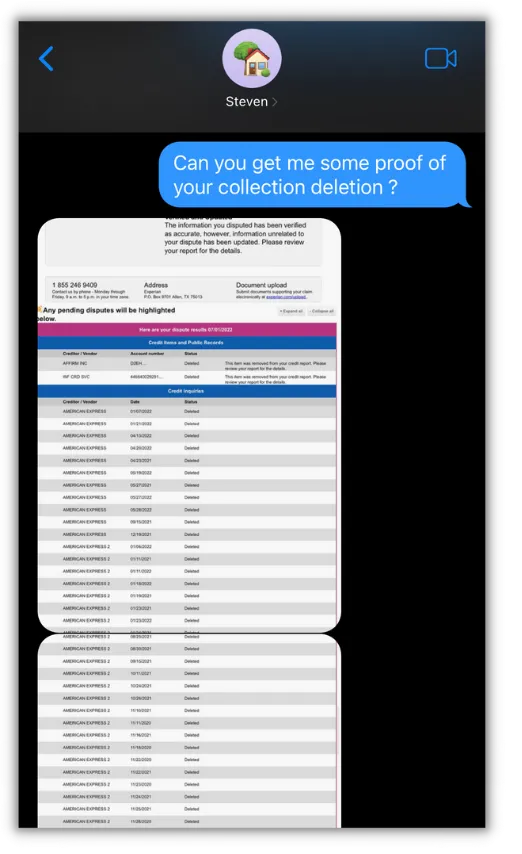

When Steven came to us, he had one of the worst credit profiles we had seen, with collections, late payments, and an overall poor history. Financing new deals in his business was becoming a nightmare, so he decided to start the cleanup process with us.

The Process:

The process of deleting all negative marks from his profile took our team almost six months. During this time, we gave Steven recommendations on how to get back in the bank's good graces to secure future business funding. In the meantime, we applied with his father and business partner's credit profile and were approved for over $80,000.

The Result:

Steven went from struggling to finance his deals to leveraging other people's money and 0% lines of credit to fund and build his real estate portfolio.

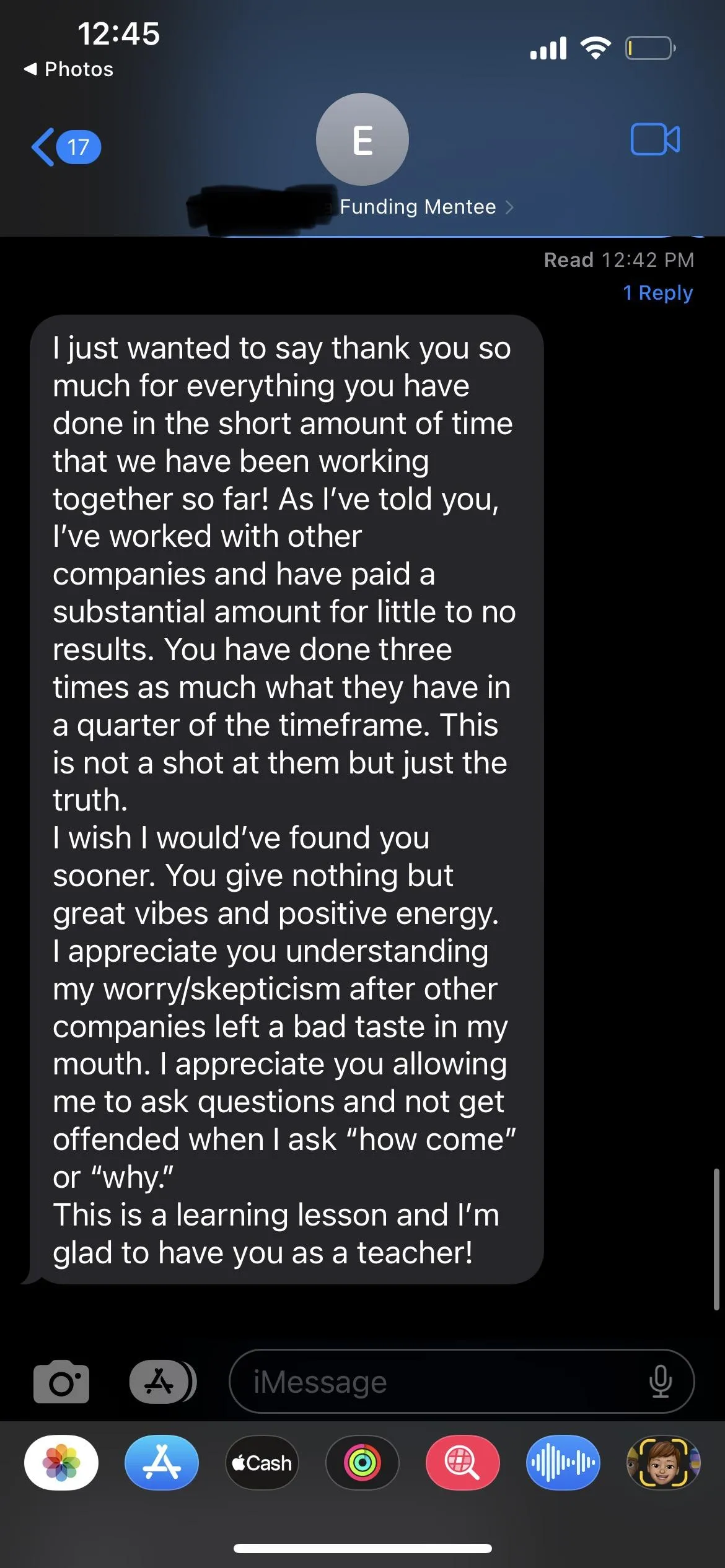

Edshaudria Pinckney

Niche: E-Commerce

Results: 0$ to 45k+ in Business Funding to purchase higher quantities of Inventory!

Thomas Enterprise Holdings: Went from $0 to 45k+ in business funding to purchase more inventory !

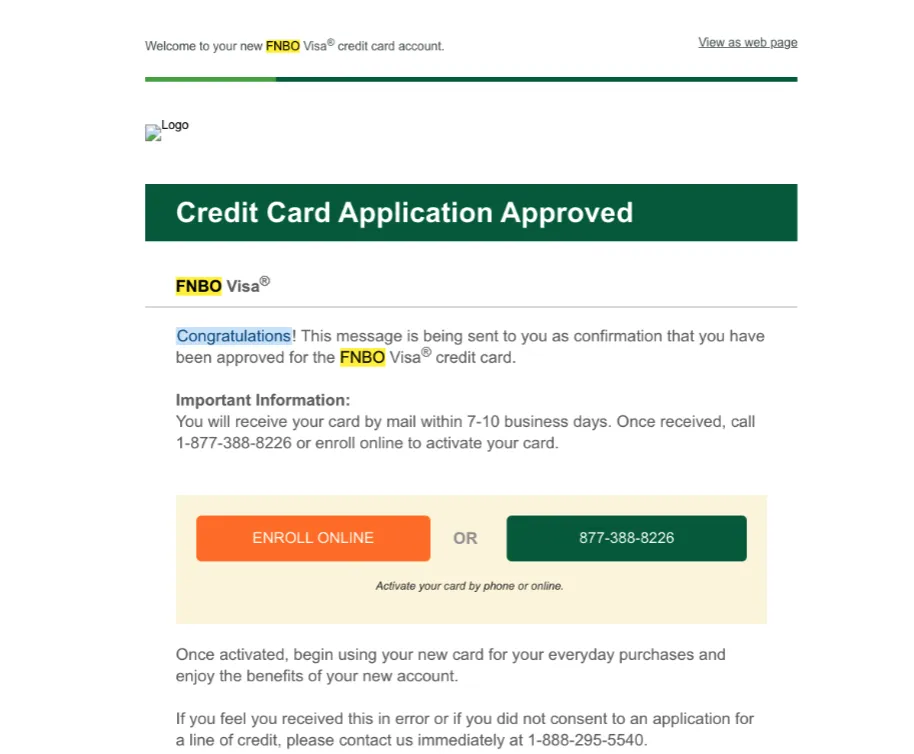

When we met Edshaudria she was working with another funding company that produced no results. She was at a point where the funding company was just applying to apply and racking up a high amount of inquiries on her credit report. She put her trust in me and we created a plan of attack to help her fulfill her funding goals.

The Process

Right away when we started the process with her we realized what the reason was as to why she was constantly getting denied. We tweaked her credit and optimized it to acquire business funding. Edshaudria did her part and followed our strategies and listened to the funding strategy we put oil place for her.

The Result

In less than 45 days, we were able to help her get approved for 45k+ in business funding. She was able to purchase more inventory for her online store and keep up with the high demand she had. Not only that but she was able to start a second business and is currently working on creating a game plan to get business funding for that business as well!

PEOPLE APPROVALS, YOU CAN BE NEXT!